Compliance Standards & Essential Measures

Contact centers serve as the cornerstone of customer engagement, handling a vast array of personal data with each interaction. This data, ranging from financial details to healthcare records, underscores the critical importance of robust security and unwavering compliance within contact centers. According to a recent industry report, contact centers are prime targets for cyberattacks, with 64% of organizations experiencing at least one data breach in the past year alone. These breaches not only compromise sensitive customer information but also incur significant financial and reputational costs, with the average data breach costing companies approximately $3.86 million.

What is Contact Center Compliance?

Contact center compliance refers to the adherence to laws, regulations, and standards governing the operations of contact centers. It covers a range of areas, such as data security, customer rights, and ethical standards. Ensuring compliance is crucial for sustaining customer confidence, preventing legal issues, and preserving the company’s reputation. Essentially, it involves legal, ethical, and professional standards aimed at ensuring respectful, private, and fair interactions with customers and employees alike.

Ensuring the confidentiality, integrity, and availability of customer data is paramount, not only to protect customer trust but also to comply with a myriad of regulatory requirements. Failure to comply with these regulations can result in severe penalties, with fines for non-compliance reaching up to 4% of annual global turnover or €20 million, whichever is higher, under the General Data Protection Regulation (GDPR). Additionally, maintaining robust security measures is crucial, as 58% of cyberattacks target small to medium-sized businesses, making contact centers a prime target due to the volume of sensitive data they handle.

One of the primary challenges is the complex regulatory landscape, with contact centers often having to comply with multiple regulations such as the Payment Card Industry Data Security Standard (PCI DSS), the Health Insurance Portability and Accountability Act (HIPAA), and the Telephone Consumer Protection Act (TCPA), among others. Moreover, the rapid pace of technological advancements introduces new security risks, with 65% of organizations experiencing a phishing attack in the past year, highlighting the need for robust security measures and ongoing training.

Call Centers Standards & Regulations

Call centers are required to adhere to various standards and regulations to ensure the protection of consumer rights, data security, and ethical business practices. Here are some key standards call centers must follow:

- Telephone Consumer Protection Act (TCPA)

The TCPA oversees telemarketing activities, including auto-dialed calls, prerecorded messages, text communications, and unsolicited fax transmissions. It requires businesses to obtain prior express written consent before contacting consumers for promotional purposes. Failure to comply with the TCPA can result in significant fines and penalties.

- National Do Not Call (DNC) Registry

The DNC Registry enables consumers to remove themselves from telemarketing call lists. Businesses are required to scrub their call lists against the DNC Registry and refrain from calling numbers listed on the registry unless they have an established business relationship with the consumer or have obtained prior express consent.

- Health Insurance Portability and Accountability Act (HIPAA) Training

HIPAA provides regulations for the protection of confidential patient records. Call centers that handle healthcare-related calls must ensure that their employees receive HIPAA training to understand the requirements for handling protected health information (PHI) and to prevent unauthorized access or disclosure of PHI.

- Payment Card Industry Data Security Standard (PCI DSS)

PCI DSS applies to businesses that process, store, or transmit credit card information. Call centers that handle payment card transactions must comply with PCI DSS requirements to ensure the secure handling of credit card data and to protect against data breaches and fraud.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Act includes provisions that regulate the financial industry to protect consumers from abusive practices. Call centers engaged in financial services must comply with Dodd-Frank’s requirements, such as providing clear and accurate information to consumers and adhering to fair debt collection practices.

- Gramm-Leach-Bliley Act (GLBA)

The GLBA requires financial institutions to protect the privacy and security of consumer financial information. Call centers that handle financial information must comply with the GLBA’s requirements for safeguarding sensitive customer data and providing privacy notices to consumers.

- Fair Debt Collection Practices Act (FDCPA)

The FDCPA regulates the collection of consumer debts and prohibits abusive, deceptive, and unfair practices by debt collectors. Call centers engaged in debt collection must comply with the FDCPA’s requirements to ensure fair treatment of consumers and to avoid legal liabilities.

- Sarbanes-Oxley Act (SOX)

SOX imposes strict financial reporting and disclosure requirements on publicly traded companies. Call centers that provide services to publicly traded companies must comply with SOX’s provisions to ensure the integrity of financial reporting and to prevent corporate fraud.

- Equal Credit Opportunity Act (ECOA)

The ECOA prohibits discrimination in credit transactions based on race, color, religion, national origin, sex, marital status, age, or receipt of public assistance. Call centers involved in credit-related activities must comply with the ECOA’s requirements to ensure fair and equal access to credit for all consumers.

- Truth in Lending Act (TILA)

TILA obligates lenders to inform consumers about the critical terms and costs of their credit transactions. Call centers that handle credit-related inquiries or transactions must comply with TILA’s requirements to provide accurate and timely disclosures to consumers regarding the terms of credit offers.

To mitigate risks, contact centers should implement multi-layered security measures, including encryption, multi-factor authentication (MFA), and regular security audits. These proactive steps help safeguard sensitive data, ensure compliance with regulatory standards, and enhance overall data protection efforts.

Key Security Measures for Contact Centers

- Data Security Best Practices

Data security is paramount for contact centers, given the sensitive nature of the information they handle. Implementing encryption for data both in transit and at rest ensures that even if intercepted, the data remains unreadable. Access controls should be implemented to restrict access to sensitive information only to authorized personnel.

- Secure Call Recording

Call recording is a common practice in contact centers for quality assurance and training purposes. However, it’s crucial to ensure that call recordings are securely stored and accessible only to authorized personnel. Encryption should be applied to call recordings and access controls should be implemented to prevent unauthorized access.

- Authentication and Access Management

Strong authentication mechanisms, such as multi-factor authentication (MFA), should be implemented to verify the identity of users accessing the contact center systems. Access management policies should be in place to ensure that users have the appropriate level of access based on their roles and responsibilities.

- Compliant Call Center Software

Choosing call center software and AI tools that comply with industry standards and regulations is essential. These tools should offer features such as secure data transmission, encryption, and compliance with relevant regulations (e.g., PCI DSS for payment processing). AI tools can also enhance security by identifying and mitigating potential security threats in real-time.

- Compliance with Regulations

Contact centers must adhere to state-specific regulations regarding data protection and privacy. Additionally, international standards such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) set requirements for the collection, processing, and storage of personal data. Compliance with these standards is crucial for protecting customer data and avoiding legal repercussions.

Compliance Monitoring and Reporting

- Incident Monitoring & Reporting

Contact centers should have systems in place to monitor and report compliance incidents effectively. This includes tracking and documenting any breaches of compliance policies or regulations. Incident reports should be detailed, including the nature of the incident, the impact, and any remedial actions taken. Regular audits and reviews of incident reports help identify patterns and prevent future incidents.

- Respecting DNC Lists

Maintaining and respecting Do-Not-Call (DNC) lists is crucial for compliance with regulations such as the Telephone Consumer Protection Act (TCPA). Contact centers must ensure that they do not contact individuals who have opted out of receiving marketing communications. Failure to comply with DNC regulations can result in hefty fines and damage to the company’s reputation.

- Customer Authentication

Authenticating customers in every inbound call helps prevent unauthorized access to sensitive information. Contact centers should implement strong authentication measures, such as knowledge-based authentication (KBA) or biometric authentication, to verify the identity of callers before providing access to account information or other sensitive data.

- Consent & Opt-In

Obtaining customer consent and opt-in before initiating communication is essential for compliance with regulations such as the GDPR and the CCPA. Contact centers should clearly explain the purpose of communication and obtain explicit consent from customers before contacting them for marketing or promotional purposes. Keeping records of consent and opt-in ensures compliance and helps resolve disputes.

- Transparent Recording

Recording and documenting every conversation transparently is critical for compliance and quality assurance purposes. Contact centers should inform customers that their calls may be recorded for training and quality purposes. Recording conversations helps resolve disputes, monitor agent performance, and ensure compliance with regulations regarding call recording and data protection.

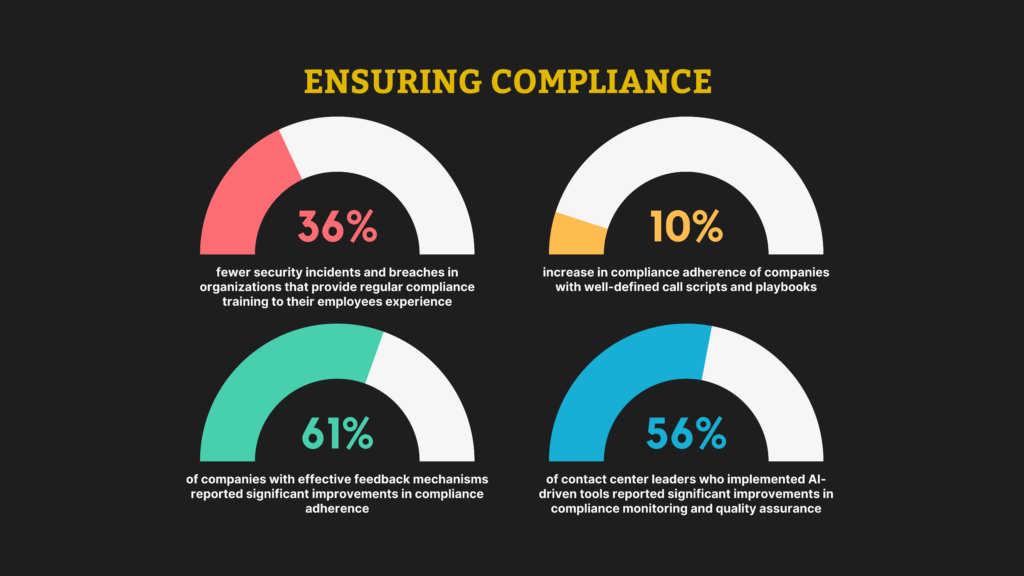

Ensuring Compliance through Agent Training and Quality Assurance

- Structured Training

Contact centers must provide agents with comprehensive training on compliance regulations and company policies. This training should be ongoing and tailored to address the specific needs of agents. Training programs should cover topics such as data protection, privacy laws, and communication guidelines. Regular assessments and refresher courses can help reinforce compliance principles and ensure that agents are up to date with the latest regulations.

- Clear Scripts

Clear call scripts and playbooks help agents communicate effectively while adhering to compliance regulations. Scripts should include guidelines on what information can be collected, how it should be collected, and how it should be used. Playbooks should also address common scenarios that agents may encounter and provide guidance on handling them in a compliant manner.

- Monitoring and Feedback

Regular monitoring of agent performance is essential for ensuring compliance. Quality assurance teams should listen to call recordings, review interactions, and provide feedback to agents. This feedback should focus on areas where agents can improve their compliance practices, such as following scripts, verifying customer identities, and obtaining consent. Performance metrics should be tracked and used to identify trends and areas for improvement.

- AI Tools

AI-driven tools can help contact centers enhance their quality assurance and compliance monitoring efforts. These tools can analyze call recordings in real-time, flagging potential compliance issues such as unauthorized data collection or non-compliant language. AI can also be used to automate compliance checks, reducing the burden on human agents and ensuring consistent monitoring across all interactions.

Avoiding Pitfalls in Contact Center Compliance

Maintaining compliance in contact centers is crucial for upholding customer trust, avoiding legal issues, and ensuring smooth operations. However, several pitfalls can hinder compliance efforts if not addressed proactively. Here are some key strategies to avoid these pitfalls:

- Compliance Audits and Clear Policies

Regular audits help identify and rectify non-compliance issues promptly. They also ensure that contact centers stay up to date with changing regulations. Clear, well-documented policies are essential. They ensure all employees understand and follow compliance with regulations. Policies should cover areas such as data protection, customer consent, and call recording. Regular training on these policies is also crucial to ensure adherence at all levels.

- Robust Security Measures and Updates

Security breaches can lead to severe compliance violations and damage the reputation of a contact center. Implementing robust security measures such as encryption, access controls, and regular security updates is essential. Regularly updating software and systems is crucial to protect against new threats and vulnerabilities. It’s also important to have backup systems in place to ensure continuity of operations in case of security breaches.

- Partnering with Compliance Experts

Compliance experts can provide valuable insights and guidance on adhering to complex regulations. They can also help in conducting regular audits and training programs. Developing a contingency plan is essential to address potential compliance breaches. This plan should include steps for mitigation and communication with stakeholders. It should also outline how the contact center will continue its operations in case of a breach.

- Automation for Compliance

Automation can significantly enhance compliance efforts by monitoring compliance in real-time. Automated systems can flag potential issues for immediate attention, reducing the risk of non-compliance. Automation also simplifies compliance processes, reducing the burden on human resources and minimizing the risk of errors. Contact centers should leverage automation tools to streamline compliance efforts and ensure adherence to regulations.